IRS Tax Forms

Pursuant to Section 7874 of The Internal Revenue Code, Diversified is treated as a U.S. corporation for all purposes under the Code. Therefore, dividends from the Company may be subject to US withholding taxes, depending on the country of residence of the shareholder, and whether the country has an income tax treaty with the United States. The statutory rate of withholding under the Code is 30 percent, which may be reduced by an applicable treaty.

For non-US Shareholders who are individuals that have not previously completed the appropriate US Withholding Tax Form, Form W-8BEN (or W-8ECI in some cases) relating to US withholding tax for non-US investors should be completed. For non-US Shareholders who are corporate entities, Form W-8BEN-E (or, if applicable, Form W-8IMY or Form W-8ECI) relating to US withholding tax for non-US investors should be completed. In some cases, Form W-8ECI may be applicable to individual Shareholders that have other U.S. taxable income and file a U.S. income tax return.

For Shareholders who complete and return the US withholding tax form relevant to them, the rate of US withholding tax will be adjusted to a rate of between 0% and 30% depending on the elections provided by the Shareholder in the Form W-8 and in accordance with the withholding rate under the applicable double income tax treaty (for example, 15% under the US-UK treaty).

A brief summary of the purpose of each of the Forms W-8 is provided below with links to the form and its instructions:

Form W-8BEN (Certification of Foreign Status of Beneficial Owner for United States Tax Withholding - Individuals) is for foreign individuals to provide their identifying information in Part I and certify in Part III that they are not U.S. taxpayers. The Form W-8BEN is also used to exempt (or reduce the rate on) certain types of payments from the 30% federal income tax withholding required under U.S. tax law (see Part II). For a valid tax treaty exemption, the recipient must provide either a U.S. tax identification number on line 5 or a foreign tax identification number on line 6.

Form W-8BEN-E (Certification of Foreign Status of Beneficial Owner for United States Tax Withholding - Entities) is the most common form used by foreign entities to certify their status under the following two withholding regimes under US tax law: (1) Internal Revenue Code (IRC) Chapter 3 withholding of tax on US source income of foreign entities, and (2) IRC Chapter 4 withholding of tax to enforce reporting on certain foreign accounts pursuant to the Foreign Account Tax Compliance Act (FATCA). Entities are required to provide their identifying information as well as FATCA classification type in Part I, and certify in Part XXIX the entity as not a US person and the entity's status under FATCA. Part III of the form is used to claim a treaty exemption (or reduced withholding rate) for certain types of payments from the 30% federal income tax withholding required under Chapter 3. Parts IV-XXVIII of the form contain separate certifications for each type of FATCA classification for which entities need only focus on the particular section that corresponds to their FATCA classification type selected in Part I. For a valid tax treaty exemption, the recipient must provide a U.S. tax identification number on line 8 or Foreign tax identification number on line 9b.

Form W-8IMY (Certification of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for U.S. Tax Withholding) is used for reporting payments to "flow-through entities" such as foreign partnerships or trusts that serve as the U.S. withholding agent for its partners or beneficiaries. Completion of this Form certifies that the entity is responsible for withholding U.S. tax and remitting such to the IRS. A U.S. tax identification number must be provided.

Form W-8ECI (Certification of Foreign Person's Claim that Income is Effectively Connected with the Conduct of a Trade or Business in the U.S.) is for exemption from withholding on income effectively connected with a trade or business in the United States. The form stipulates that the foreign entity files yearly U.S. income tax returns to report all income claimed to be effectively connected with a U.S. trade or business. In order for the form to be completed properly, a U.S. tax identification number must be provided.

Shareholders who have not completed and returned the appropriate W-8 Form will receive dividends after deduction of US withholding tax of 30%.

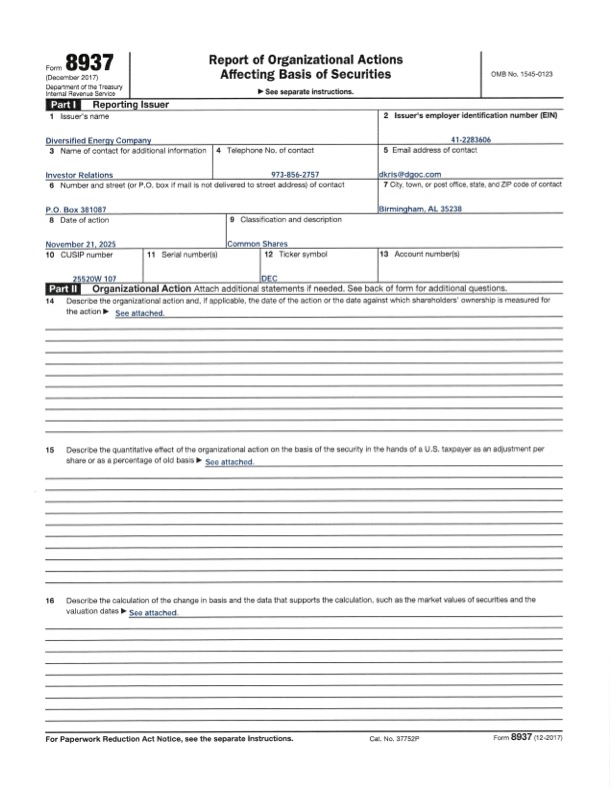

2017 Form 8937

2017 Form 8937 2026 form 8937

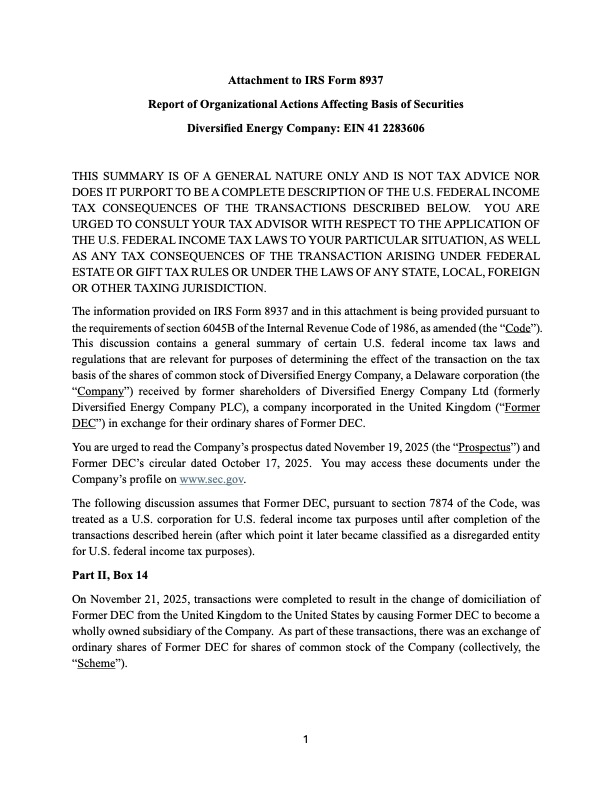

2026 form 8937 2026 form 8937 - Attachment

2026 form 8937 - Attachment