EXHIBIT 99.1

Published on November 20, 2025

Exhibit 99.1

This document comprises a prospectus under Article 3 of the UK version of Regulation (EU) 2017/1129 which forms part of UK law by virtue of the European Union (Withdrawal) Act 2018 as amended (the “UK Prospectus Regulation”) relating to Diversified Energy Company (the “Company”) prepared in accordance with the UK Prospectus Regulation Rules of the Financial Conduct

Authority (the “FCA”) made under Section 73A of the Financial Services and Market Act 2000, as amended (the “FSMA”). This Prospectus has been approved by the FCA, as

competent authority under the UK Prospectus Regulation. The FCA only approves this Prospectus as meeting the standards of completeness, comprehensibility and consistency imposed by the UK Prospectus Regulation and such approval should not be

considered as an endorsement of the Company that is the subject of this Prospectus. Investors should make their own assessment as to the suitability of investing in the shares of common stock, par value $0.01 per share, of the Company (the “Shares”). This document has been filed with the FCA in accordance with the UK Prospectus Regulation Rules and will be made available to the public in accordance with UK Prospectus Regulation Rule 3.2.1 by the

same being made available, free of charge, at https://ir.div.energy/.

This Prospectus is not an offer or invitation to the public to subscribe for or purchase Shares and has been prepared solely in connection with the proposed admission (“Admission”) of the entire issued and to be issued share capital of the Company to listing on the Equity Shares (International Commercial Companies Secondary Listing) Category (“ESICC”) of the

official list of the FCA (the “Official List”) and to trading on the main market for listed securities (“Main Market”) of London Stock Exchange plc (“London Stock Exchange”) in connection with a scheme of arrangement pursuant to Part 26 of the

Companies Act to introduce a new Delaware-incorporated holding company, Diversified Energy Company, as the holding company of the Group, and the issue of Shares relating to the acquisition of Canvas Energy, Inc. by the Group. The Prospectus has

been prepared on the assumption that the Scheme will become effective in accordance with its current terms and the Canvas Acquisition will be completed as presently envisaged. A summary of the Scheme and the acquisition of Canvas is set out in Part

1 of this document.

The Company, the director and proposed directors of the Company (together, the “Directors”), whose names appear on page 41 of this document, accept

responsibility for the information contained in this document. To the best of the knowledge of the Company and the Directors, the information contained in this document is in accordance with the facts and this document makes no omission likely to

affect its import.

DIVERSIFIED ENERGY COMPANY (the “Company”)

(Incorporated and registered in the State of Delaware, United States with registered number 10359877)

Admission of up to 80,620,444 New Shares to the Equity Shares (International Commercial Companies Secondary Listing) Category of the Official List and to trading on the

Main Market of the London Stock Exchange

The whole of the text of this document should be read in its entirety. Your attention is also drawn, in particular, to the section headed “Risk Factors”

at the beginning of this document which sets out certain risks and other factors that should be taken into account by investors. YOU SHOULD NOT RELY SOLELY ON INFORMATION SUMMARISED IN THE SECTION OF THIS DOCUMENT ENTITLED “SUMMARY”.

Applications will be made to the FCA for admission of the New Shares to listing on the ESICC Category of the Official List and to the London Stock Exchange for all the New Shares to be admitted to trading on the Main

Market. If the Scheme proceeds as presently envisaged, it is expected that the Exchange Shares Admission will become effective, and that dealings in the Exchange Shares on the Main Market will commence, at 8.00 a.m. (London time) on 24 November

2025. An application has been made for the Exchange Shares to also be listed on the NYSE. Further, if the acquisition of Canvas is completed as presently envisaged, it is expected that the Consideration Shares Admission will become effective, and

that dealings in the Consideration Shares on the Main Market will commence, at 8.00 a.m. (London time) on 25 November 2025. An application has been made for the Consideration Shares to also be listed on the NYSE.

Notice to US Shareholders

The Shares have not been, and will not be, registered under the US Securities Act of 1933, as amended (the “US Securities Act”) or under the

securities laws of any state or other jurisdiction of the United States. The Exchange Shares will be issued in reliance upon the exemption from the registration requirements of the US Securities Act provided by Section 3(a)(10) thereof, and the

Consideration Shares will be issued in reliance upon the exemption from the registration requirements of the US Securities Act provided by Section 4(a)(2) thereof. Neither the US Securities Exchange Commission (the “SEC”)

nor any US state securities commission has approved or disapproved of the issuing of the Shares, or determined if this document, any accompanying documents or the Scheme is accurate or complete. Any representation to the contrary is a criminal

offence in the United States.

Non-solicitation

This Prospectus shall not constitute an offer to sell or the solicitation of an offer to buy any securities, including under the US federal securities laws, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

General Notice

The distribution of this document in certain jurisdictions may be restricted by law and therefore persons into whose possession this document comes should inform themselves about and observe any such restrictions in

relation to the Shares or this document, including those in the paragraphs that follow. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction. Except in the United Kingdom and the

United States, no action has been taken or will be taken in any jurisdiction that would permit possession or distribution of this document in any country or jurisdiction where action for that purpose is required. Accordingly, this document may not

be distributed or published in any jurisdiction where to do so would breach any securities laws or regulations of any such jurisdiction or give rise to an obligation to obtain any consent, approval or permission, or to make any application, filing

or registration. Failure to comply with these restrictions may constitute a violation of the securities laws or regulations of such jurisdictions.

The contents of this document must not to be construed as legal, business or tax advice. Each prospective investor should consult his or her own lawyer, independent financial adviser or tax adviser for legal,

financial or tax advice in relation to any dealing or proposed dealing in Shares. Investors must inform themselves as to: (i) the legal requirements within their own countries for the purchase, holding, transfer, redemption or other disposal of

Shares; (ii) any foreign exchange restrictions applicable to the purchase, holding, transfer or other disposal of Shares which they might encounter; and (iii) the income and other tax consequences which may apply in their own countries as a result

of the purchase, holding, transfer or other disposal of Shares. Investors must rely on their own representatives, including their own legal advisers, financial advisers, tax advisers and accountants, as to legal, financial, business, investment,

tax, or any other related matters concerning the Company and an investment therein. Neither the Company nor its representatives is making any representation to any purchaser of Shares regarding the legality of an investment in the Shares by such

purchaser under the laws applicable to such offeree or purchaser.

Subject to the FSMA, the Listing Rules, the UK Prospectus Regulation Rules, and the DTRs, the delivery of this document shall not, under any circumstances, create any implication that there has been no change in the

affairs of the Company since the date of this document or that the information in this document is correct as at any time after this date.

The Company will publish a supplement to this Prospectus if a significant new factor, material mistake or material inaccuracy relating to the information in this document that may affect the assessment of the

securities and which arises or is noted between the time when the document was approved and the date that is the later of the date on which the Exchange Shares Admission and the Consideration Shares Admission occurs. This document and any

supplement will be made public in accordance with the UK Prospectus Regulation by publication on the Company’s website at https://ir.div.energy/.

Unless expressly stated otherwise, references to an EU regulation shall be to that regulation as it forms part of the law of England and Wales by virtue of the European Union (Withdrawal) Act 2018 (as amended) and as

the law of England and Wales is amended or re-enacted as at the date of this document.

Without limitation, the contents of the Group’s websites (other than the information as set out in Part 7 (“Documents Incorporated by Reference”)), or of any website

accessible via hyperlinks from the Group’s websites, do not form part of this document.

This document is dated 19 November 2025.

|

TABLE OF CONTENTS

|

|

|

Page

|

|

|

SUMMARY

|

2

|

|

RISK FACTORS

|

8

|

|

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

|

35

|

|

DIRECTORS, COMPANY SECRETARY, REGISTERED OFFICE AND ADVISERS

|

41

|

|

EXPECTED TIMETABLE OF PRINCIPAL EVENTS AND ADMISSION STATISTICS

|

42

|

|

PART 1 THE SCHEME OF ARRANGEMENT

|

44

|

|

PART 2 INFORMATION ON THE GROUP

|

49

|

|

PART 3 FINANCIAL INFORMATION RELATING TO THE GROUP

|

73

|

|

PART 4 OPERATING AND FINANCIAL REVIEW

|

74

|

|

PART 5 CAPITALISATION AND INDEBTEDNESS

|

76

|

|

PART 6 ADDITIONAL INFORMATION

|

78

|

|

PART 7 DOCUMENTS INCORPORATED BY REFERENCE

|

130

|

|

PART 8 TECHNICAL TERMS

|

132

|

|

PART 9 DEFINITIONS

|

134

|

|

PART 10 HISTORICAL FINANCIAL INFORMATION RELATING TO THE MAVERICK GROUP

|

140

|

SUMMARY

INTRODUCTION

This summary should be read as an introduction to this document. Any decision to invest in the securities of the Company should be based on consideration of this document as a whole by the

investor. Investors could lose all or part of their invested capital.

Civil liability attaches only to those persons who have tabled the summary including any translation thereof, but only where the summary is misleading, inaccurate or inconsistent when read

together with the other parts of this document or where it does not provide, when read together with the other parts of this document, key information in order to aid investors when considering whether to invest in the Shares.

The legal name of the Company is Diversified Energy Company. The Company’s registered office is at 1209 Orange Street, Wilmington, Delaware 19801 and its LEI is 529900XTQ3OKXR6P0H74.

The Shares will be registered with International Securities Identification Number (“ISIN”) US25520W1071 and will trade under the symbol “DEC”.

This document has been approved in accordance with the Prospectus Regulation on 19 November 2025 by the UK Financial Conduct Authority (the “FCA”), as competent authority,

having its head office at 12 Endeavour Square, London, E20 1JN and telephone number +44 (0)20 7066 1000.

KEY INFORMATION ON THE ISSUER

Who is the issuer of the securities?

The Company is the issuer of the Shares. The Company is a corporation existing under the laws of the State of Delaware, United States. The Company currently operates under the General Corporation Law of the State of

Delaware, as from time to time amended. The Company’s registered number is 10359877 and the Company’s LEI is 529900XTQ3OKXR6P0H74.

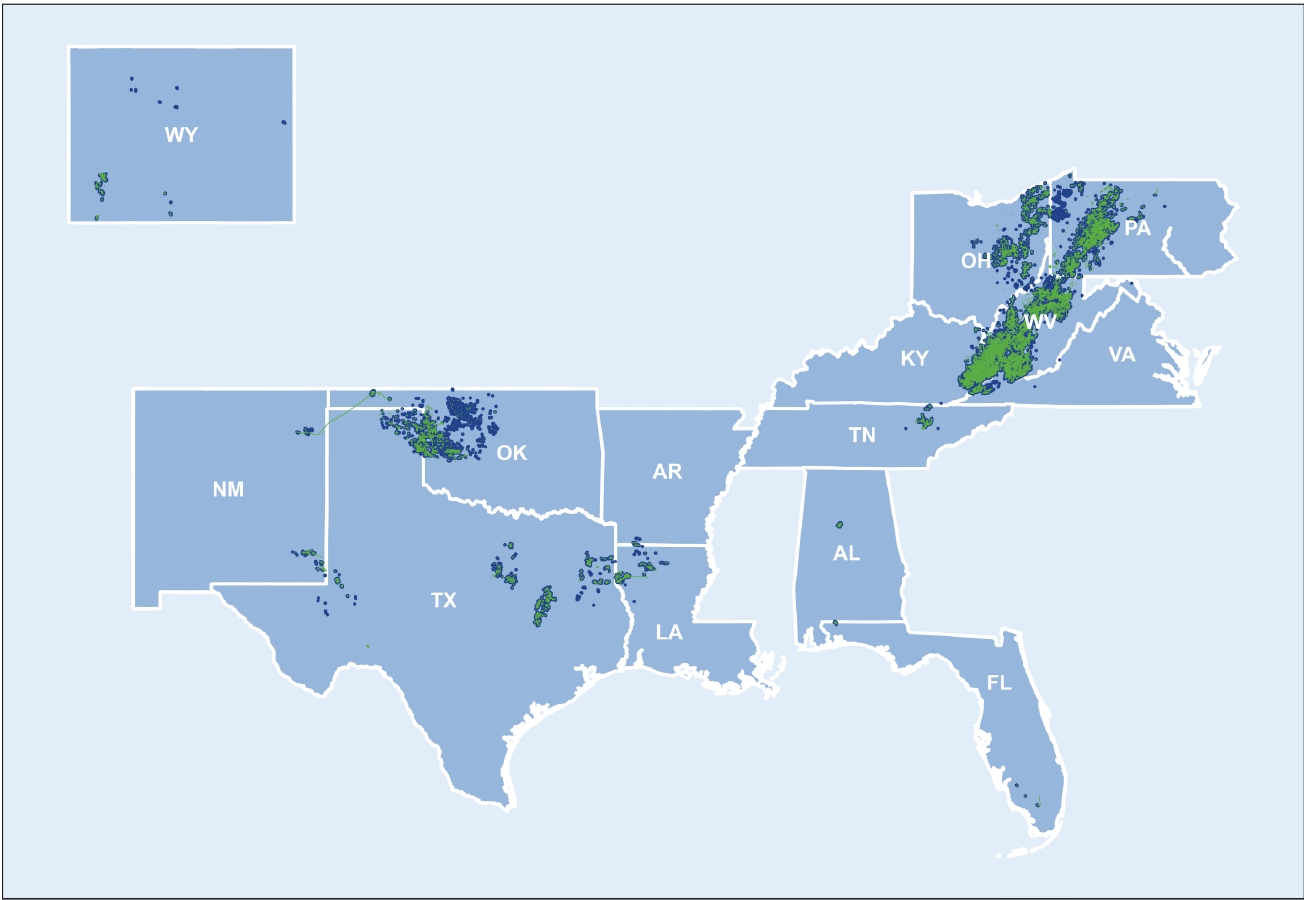

The Company has been incorporated to be the ultimate holding company for the Group. Diversified is a leading independent energy company focused on natural gas and liquids production, transportation, marketing and

well retirement, primarily located within the Appalachian and Central regions of the United States. The Appalachian Basin spans Pennsylvania, Virginia, West Virginia, Kentucky, Tennessee and Ohio and consists of multiple productive, shallow

conventional formations and two productive, deeper unconventional shale formations, the Marcellus Shale and the slightly deeper Utica Shale. Diversified also operates in the Bossier and Haynesville shale formations and the Cotton Valley sandstones

in East Texas and West Louisiana, the Barnett Shale in North Texas and the Mid-Continent producing areas across Central Texas, along with the Anadarko Basin across North Texas and Oklahoma and Permian Basin in West Texas and New Mexico.

The Company was incorporated in 2025 in the State of Delaware, United States, as the successor to Old DEC, which was incorporated in 2014. The Group’s predecessor business was co-founded in 2001 by the Chief

Executive Officer, Robert Russell “Rusty” Hutson, Jr., with an initial focus primarily on natural gas and oil production in West Virginia. In recent years, the Group has grown rapidly by capitalising on opportunities to acquire and enhance

producing assets and by leveraging the operating efficiencies that result from economies of scale and vertical integration. As of 30 June 2025, the Group had completed 29 acquisitions since 2017 for a combined purchase price of approximately $3.6

billion.

There is no offer of the Company’s securities.

2

Major interests in Existing Shares

As at the Latest Practicable Date, there are no notifiable interests in the Company’s issued share capital or voting rights. Insofar as is known to the Company as at the Latest

Practicable Date, the following persons will be interested in 5 per cent. or more of the Company’s voting rights immediately following the New Shares Admission:

|

Shareholder

|

Number of Shares

|

Percentage of Shares (%)

|

||||||

|

EIG Global Energy Partners LLC

|

9,601,585

|

12.4

|

||||||

|

BlackRock

|

4,046,531

|

5.27

|

||||||

|

The Vanguard Group

|

4,419,263

|

5.76

|

||||||

|

Columbia Threadneedle Investments (US)

|

4,108,991

|

5.36

|

||||||

Directors

The director of the Company is Robert Russell “Rusty” Hutson, Jr. (Chief Executive Officer) (the “Director”). The proposed directors of

the Company are: David Edward Johnson (Independent Non-executive Chair), Martin Keith Thomas (Non-executive Director), David

Jackson Turner, Jr. (Independent Non-executive Director and Senior Independent Director), Kathryn Z. Klaber (Independent

Non-executive Director) and Randall Scott Wade (Non-executive Director) (together, the “Proposed Directors”). The Proposed Directors are expected to be

appointed with effect from the Scheme becoming effective.

Statutory Auditors

PricewaterhouseCoopers LLP, 569 Brookwood Village #851, Birmingham, Alabama, United States is expected to be appointed as the statutory auditor of the Company with effect from the Scheme becoming effective.

PricewaterhouseCoopers LLP is a member firm of the Public Company Accounting Oversight Board and has no material interest in the Company.

Old DEC Group’s statutory auditor for the financial years ended 31 December 2024, 31 December 2023 and 31 December 2022 was PricewaterhouseCoopers LLP, 1 Embankment Place, London, WC2N 6RH, United Kingdom (“PwC UK”).

What is the key financial information regarding the issuer?

The Company

The Company has not traded since its date of incorporation and as such there is no historical key financial information on the Company.

Group

The tables below set out selected key financial information for the Old DEC Group. The financial information has been extracted without material adjustment from the audited consolidated financial statements of the

Old DEC Group as at and for the years ended 31 December 2024, 31 December 2023 and 31 December 2022 and the unaudited interim condensed consolidated financial statements of the Old DEC Group as at and for the six-month period ended 30 June 2025

(the “Group Financial Statements”).

Selected Consolidated Income Statement Data

|

Six months ended 30 June

|

Year ended 31 December

|

|||||||||||||||||||

|

2025

|

2024

|

2024

|

2023

|

2022

|

||||||||||||||||

|

(unaudited)

|

(unaudited)

|

|||||||||||||||||||

|

In US$ ’000 (except earnings per ordinary share)

|

||||||||||||||||||||

|

Revenue

|

778,065

|

368,674

|

794,841

|

868,263

|

1,919,349

|

|||||||||||||||

|

Gross profit

|

268,255

|

53,342

|

109,455

|

203,155

|

1,251,199

|

|||||||||||||||

|

Net income/(loss) after tax

|

(33,926

|

)

|

15,745

|

(87,001

|

)

|

759,701

|

(620,598

|

)

|

||||||||||||

|

Period on period growth in revenue

|

111

|

%

|

(8.46

|

%)

|

(54.76

|

%)

|

||||||||||||||

|

Earnings per ordinary share (basic) ($)

|

(0.50

|

)

|

0.32

|

(1.84

|

)

|

16.07

|

(14.82

|

)

|

||||||||||||

|

Earnings per ordinary share (diluted) ($)

|

(0.50

|

)

|

0.32

|

(1.84

|

)

|

15.95

|

(14.82

|

)

|

||||||||||||

3

Selected Consolidated Balance Sheet Data

|

As at 30

June

|

As at 31 December

|

|||||||||||||||

|

2025

|

2024

|

2023

|

2022

|

|||||||||||||

|

(unaudited)

|

||||||||||||||||

|

In US$ ’000

|

||||||||||||||||

|

Total assets

|

5,662,821

|

4,003,525

|

3,474,022

|

3,830,928

|

||||||||||||

|

Total equity

|

727,686

|

464,556

|

598,410

|

(137,724

|

)

|

|||||||||||

|

Total liabilities

|

4,935,135

|

3,538,969

|

2,875,612

|

3,968,652

|

||||||||||||

Selected Consolidated Cash Flow Data

|

Six months ended 30 June

|

Year ended 31 December

|

|||||||||||||||||||

|

2025

|

2024

|

2024

|

2023

|

2022

|

||||||||||||||||

|

(unaudited)

|

(unaudited)

|

|||||||||||||||||||

|

In US$ ’000

|

||||||||||||||||||||

|

Net cash provided by operating activities

|

264,135

|

160,810

|

345,663

|

410,132

|

387,764

|

|||||||||||||||

|

Net cash used in investing activities

|

(259,020

|

)

|

(183,648

|

)

|

(272,916

|

)

|

(239,369

|

)

|

(386,457

|

)

|

||||||||||

|

Net cash provided by financing activities

|

12,638

|

22,568

|

(70,510

|

)

|

(174,339

|

)

|

(6,536

|

)

|

||||||||||||

There are no qualifications to the independent auditors’ report on the historical financial information for the financial years ended 31 December 2024, 31 December 2023 and 31 December 2022 or the independent review

report for the six-month period ended 30 June 2025.

What are the key risks that are specific to the issuer?

| (1) |

Volatility and future decreases in natural gas, NGLs and oil prices could materially and adversely affect the Group’s business, results of operations, financial condition, cash flows or prospects.

|

| (2) |

The Group conducts its business in a highly competitive industry.

|

| (3) |

The Group may experience delays in production, marketing and transportation.

|

| (4) |

The Group faces production risks and hazards, including severe weather events, that may affect the Group’s ability to produce natural gas, NGLs and oil at expected levels, quality and costs that may result in additional liabilities to

the Group.

|

| (5) |

The levels of the Group’s natural gas and oil reserves and resources, their quality and production volumes may be lower than estimated or expected.

|

| (6) |

The Group may face unanticipated increased or incremental costs in connection with decommissioning obligations such as plugging.

|

| (7) |

The Group may not be able to keep pace with technological developments in its industry or be able to implement them effectively.

|

| (8) |

A lowering or withdrawal of the ratings, outlook or watch assigned to the Group or its debt by rating agencies may increase the Group’s future borrowing costs and reduce its access to capital.

|

| (9) |

Deterioration in the economic conditions in any of the industries in which the Group’s customers operate, a US or worldwide financial downturn, or negative credit market conditions could have a material adverse effect on the Group’s

liquidity, results of operations, business and financial condition that it cannot predict.

|

| (10) |

The Group’s operations are subject to a series of risks relating to climate change.

|

4

Part 3

What are the main features of the securities?

As at the date of this document, the issued and outstanding share capital of the Company is one share of common stock of par value $0.01 (such share being fully paid) (the shares of common stock in the capital of the

Company from time to time, the “Shares”).

Under the Scheme, the holders of ordinary shares of £0.20 each in the capital of Old DEC (or depositary interests representing ordinary shares), save for any ordinary shares held by the Company (the “Existing Shares”) will receive one new Share (or depositary interest representing one new Share) (the “Exchange Shares”) for every

one Existing Share (or depositary interests representing an Existing Share). Further, in connection with the acquisition of Canvas Energy, Inc., the Company is proposing to issue up to 3,894,776 new Shares (the “Consideration

Shares”, and together with the Exchange Shares, the “New Shares”).

When admitted to trading on the Equity Shares (International Commercial Companies Secondary Listing) Category (“ESICC”) of the official list of the FCA (the “Official List”) and to trading on the main market for listed securities (“Main Market”) of London Stock Exchange plc (“London Stock

Exchange”), the New Shares will be registered with International Securities Identification Number (“ISIN”) number US25520W1071 and Stock Exchange Daily Official List (“SEDOL”) number BMHXS56 and will be traded under the symbol “DEC” on the London Stock Exchange. The New Shares will be listed and traded under the symbol “DEC” on the New York Stock Exchange (“NYSE”)

as well.

The New Shares will rank pari passu in all respects with each other. The holders of the New Shares are entitled to one vote for each share on all matters submitted to a

stockholder vote and have equal rights to participate in capital, dividend and profit distributions by the Company. The holders of the New Shares have no pre-emptive rights, no conversion rights, and there are no redemption provisions applicable to

the New Shares.

The Shares are, and the New Shares will be, denominated in US dollars. The New Shares will be quoted and traded in Pounds Sterling on the London Stock Exchange and in US dollars on the NYSE.

In the event of the liquidation, dissolution or winding-up or any other distribution of the Company’s assets among its shareholders for the purpose of winding-up its affairs, whether voluntarily or involuntarily, the

holders of Shares will be entitled to share rateably in any assets remaining after the satisfaction in full of the prior rights of creditors, including holders of Company indebtedness, and the payment of the aggregate liquidation preference of any

preferred stock.

Restrictions on free transferability of Shares

There are no restrictions on the free transferability of the Shares, except for those Shares that will bear a restrictive legend prohibiting such Shares from being freely transferred in the United States whether

pursuant to a contractual restriction or applicable US securities laws.

Dividend policy

The Group has consistently declared dividends on the Existing Shares since its listing on the AIM Market of the London Stock Exchange in 2017. The Board currently expects to declare a dividend of $0.29 per share each

quarter which equates to $1.16 per year. This quarterly dividend payment, on an annualised basis, currently delivers a yield in the top quartile of the FTSE 250 share index and the top decile among the Russell 2000 Index. While the Board cannot

provide assurance that the Company will, following the effectiveness of the Scheme, be able to pay cash dividends on the Shares in future periods, subject to certain restrictions, including those related to Delaware law, and the terms of the

Group’s Credit Facility and the Nordic Bonds, for the financial year ended 31 December 2024, the Group paid a dividend of $1.16 per Existing Share and for the six months ended 30 June 2025, the Group has paid dividends of an aggregate of

approximately $40 million.

5

Under Delaware law, the Company may only pay dividends (i) out of the Company’s surplus (defined as net assets minus capital); or (ii) if there is no surplus, out of the Company’s net profits from the prior fiscal

year, provided that no dividend may be paid from net profits if the Company’s capital is less than the aggregate amount of capital represented by the issued and outstanding shares of classes having a preference on the distribution of assets. In

addition, the Company’s ability to pay dividends is limited by restrictions under the terms of certain of its credit facilities. For example, the Group’s Credit Facility and Nordic Bonds contain restricted payment covenants that limit the Group’s

subsidiaries’ ability to make certain payments, based on the pro forma effect thereof on certain financial ratios.

The declaration of any future dividends will be at the discretion of the Board. The Board has not adopted, and does not currently intend to adopt, a formal written Company shareholder dividend policy and the

Directors may revise the Group’s dividend strategy from time to time in line with the actual results and financial position of the Group.

Where will the securities be traded?

Applications will be made to the London Stock Exchange for all of the New Shares to be admitted to listing on the equity shares (international commercial companies secondary listing) category of the Official List of

the FCA and to trading on the London Stock Exchange’s Main Market for listed securities.

Application has been made for the New Shares to be approved for listing on the NYSE.

No application has been made or is currently intended to be made for the Shares to be admitted to listing or trading on any other exchanges.

What are the key risks that are specific to the securities?

The key risks specific to the securities are as follows:

| (1) |

The price of Shares may be volatile and purchasers of the Shares could incur substantial losses.

|

| (2) |

Shareholders may be subject to US withholding or income tax depending on their country of residence and their ownership percentages.

|

| (3) |

There is no guarantee that the Company will continue to pay dividends in the future.

|

| (4) |

Admission may not occur when expected or an active trading market for the Shares may not develop following the New Shares Admission.

|

KEY INFORMATION ON THE OFFER AND/OR THE ADMISSION TO TRADING ON A REGULATED MARKET

Under which conditions and timetable can I invest in this security?

This Prospectus does not constitute an offer or invitation to any person to subscribe for or purchase any Shares in the Company. It is currently expected that admission of the Exchange Shares to listing on the ESICC

Category of the Official List will become effective and dealings in the Shares on the London Stock Exchange’s Main Market for listed securities will become effective at 8.00 a.m. (London time) on or around 24 November 2025 (the “Exchange Shares Admission”), and admission of the Consideration Shares to listing on the ESICC Category of the Official List will become effective and dealings in the

Shares on the London Stock Exchange’s Main Market for listed securities will become effective at 8.00 a.m. (London time) on or around 25 November 2025 (the “Consideration Shares Admission”, and together with

the Exchange Shares Admission, the “New Shares Admission”).

6

The expenses of, and incidental to, the New Shares Admission payable by the Group, including professional fees and commissions and the costs of preparation, printing and

distribution of documents, the London Stock Exchange fee, and the FCA’s listing fee, are estimated to amount to approximately £3 million (exclusive of any applicable value added tax). No expenses will be charged to investors in connection with the New Shares Admission. All expenses in relation to the New Shares Admission will be borne by the Group.

Who is the offeror and/or the person asking for admission to trading?

The Company will apply to the London Stock Exchange for all of the New Shares to be admitted to trading on the London Stock Exchange’s Main Market for listed securities.

Why is this document being produced?

The Prospectus is only being produced in connection with the New Shares Admission only.

The Group is substantially a US business, reporting in US dollars, with all the Group’s operating profit derived from the US, which is also the sole growth market for the business. The Group’s executive management

team and operational headquarters are based in the United States and all of the Group’s employees reside, and all its assets are located, in the US. In addition, as at the Latest Practicable Date, over 65 per cent. of the Company’s shareholders

were located in the US. Therefore, the Group is undertaking a corporate reorganisation to introduce a Delaware incorporated company as the parent company of the Group. The insertion of the Company as the parent company of the Group is being

effected through a Court-sanctioned scheme of arrangement under section 899 of the Companies Act pursuant to which shareholders in Old DEC will become shareholders in the Company and the Exchange Shares will be issued by the Company.

In addition, the Company is also proposing, subject to certain conditions, to issue up to 3,894,776 Consideration Shares in accordance Article 1(4) of the UK Prospectus Regulation in connection with the acquisition

of Canvas Energy, Inc.

This Prospectus does not constitute an offer or invitation to any person to subscribe for or purchase any securities in the Company. The Company will not receive any proceeds as a result of the New Shares Admission.

The Group has not entered into any underwriting arrangements in connection with the Proposals.

Material conflicts of interest

There are no conflicting interests which are material in connection with the New Shares Admission.

7

Any investment in the Shares is subject to a number of risks. Accordingly, Shareholders and prospective investors should carefully consider the factors and risks associated with any investment in

the Shares, the Group’s business and the industry in which the Group operates, together with all other information contained in this document and all of the information incorporated by reference into this document, including, in particular, the

risk factors described below, and their personal circumstances prior to making any investment decision.

The Group’s business, results of operations, financial condition, cash flows or prospects could be materially and adversely affected by any of the risks described below. The risks relating to the

Group, its industry and the Shares summarised in the section of this document headed “Summary” are the risks that the Directors believe to be the most essential to an assessment by a prospective investor of whether to consider an investment in the

Shares. However, as the risks which the Group faces relate to events and depend on circumstances that may or may not occur in the future, prospective investors should consider not only the information on the key risks summarised in the section of

this document headed “Summary” but also, among other things, the risks and uncertainties described below.

The risk factors described below are not an exhaustive list or explanation of all risks which investors may face when making an investment in the Shares. Additional risks and uncertainties

relating to the Group that are not currently known to the Group, or that it currently deems immaterial, may individually or cumulatively also have a material adverse effect on the Group’s business, results of operations, financial condition, cash

flows or prospects. If any such risk, or any of the risks described below, should materialise, the price of the Shares may decline and investors could lose all or part of their investment. Investors should consider carefully whether an investment

in the Shares is suitable for them in the light of the information in this document and their personal circumstances.

Prospective investors should read this section in conjunction with this entire document (including the information incorporated into this document by reference).

Volatility and future decreases in natural gas, NGLs and oil prices could materially and adversely affect the Group’s business, results of operations, financial condition, cash

flows or prospects.

The Group’s business, results of operations, financial condition, cash flows or prospects depend substantially upon prevailing natural gas, NGL and oil prices, which may be adversely impacted by unfavorable global,

regional and national macroeconomic conditions, including but not limited to instability related to the military conflict in Ukraine and the Israel-Gaza war. Natural gas, NGLs and oil are commodities for which prices are determined based on global

and regional demand, supply and other factors, all of which are beyond the Group’s control.

Historically, prices for natural gas, NGLs and oil have fluctuated widely for many reasons, including:

| • |

global and regional supply and demand, and expectations regarding future supply and demand, for gas and oil products;

|

| • |

global and regional economic conditions;

|

| • |

evolution of stocks of oil and related products;

|

| • |

increased production due to new extraction developments and improved extraction and production methods;

|

| • |

geopolitical uncertainty;

|

| • |

threats or acts of terrorism, war or threat of war, which may affect supply, transportation or demand;

|

| • |

weather conditions, natural disasters, climate change and environmental incidents;

|

8

| • |

access to pipelines, storage platforms, shipping vessels and other means of transporting, storing and refining gas and oil, including without limitation, changes in availability of, and access to, pipeline ullage;

|

| • |

prices and availability of alternative fuels;

|

| • |

prices and availability of new technologies affecting energy consumption;

|

| • |

increasing competition from alternative energy sources;

|

| • |

the ability of OPEC and other oil-producing nations, to set and maintain specified levels of production and prices;

|

| • |

political, economic and military developments in gas and oil producing regions generally;

|

| • |

governmental regulations and actions, including the imposition of export restrictions and taxes and environmental requirements and restrictions as well as anti-hydrocarbon production policies;

|

| • |

trading activities by market participants and others either seeking to secure access to natural gas, NGLs and oil or to hedge against commercial risks, or as part of an investment portfolio; and

|

| • |

market uncertainty, including fluctuations in currency exchange rates, and speculative activities by those who buy and sell natural gas, NGLs and oil on the world markets.

|

It is impossible to accurately predict future gas, NGL and oil price movements. Historically, natural gas prices have been highly volatile and subject to large fluctuations in response to relatively minor changes in

the demand for natural gas. According to the U.S. Energy Information Administration, the historical high and low Henry Hub natural gas spot prices for the following periods were as follows: in 2022, high of $9.85 and low of $3.46, in 2023, high of

$3.78 and low of $1.74, and in 2024, high of $13.20 and low of $1.21 — highlighting the volatile nature of commodity prices.

The economics of producing from some wells and assets may also result in a reduction in the volumes of the Group’s reserves which can be produced commercially, resulting in decreases to the Group’s reported reserves.

Additionally, further reductions in commodity prices may result in a reduction in the volumes of the Group’s reserves. The Group might also elect not to continue production from certain wells at lower prices, or the Group’s license partners may not

want to continue production regardless of the Group’s position.

Each of these factors could result in a material decrease in the value of the Group’s reserves, which could lead to a reduction in the Group’s natural gas, NGLs and oil development activities and acquisition of

additional reserves. In addition, certain development projects or potential future acquisitions could become unprofitable as a result of a decline in price and could result in the Group postponing or canceling a planned project or potential

acquisition, or if it is not possible to cancel, to carry out the project or acquisition with negative economic impacts. Further, a reduction in natural gas, NGL or oil prices may lead the Group’s producing fields to be shut down and to be entered

into the decommissioning phase earlier than estimated.

The Group’s revenues, cash flows, operating results, profitability, dividends, future rate of growth and the carrying value of the Group’s gas and oil properties depend heavily on the prices the Group receives for

natural gas, NGLs and oil sales. Commodity prices also affect the Group’s cash flows available for capital investments and other items, including the amount and value of the Group’s gas and oil reserves. In addition, the Group may face gas and oil

property impairments if prices fall significantly. In light of the continuing increase in supply coming from the Utica and Marcellus shale plays of the Appalachian Basin, no assurance can be given that commodity prices will remain at levels which

enable the Group to do business profitably or at levels that make it economically viable to produce from certain wells and any material decline in such prices could result in a reduction of the Group’s net production volumes and revenue and a

decrease in the valuation of the Group’s production properties, which could materially and adversely impact the Group’s business, results of operations, financial condition, cash flows or prospects.

9

The Group conducts its business in a highly competitive industry.

The gas and oil industry is highly competitive. The key areas in which the Group faces competition include:

| • |

engagement of third-party service providers whose capacity to provide key services may be limited;

|

| • |

acquisition of other companies that may already own licenses or existing producing assets;

|

| • |

acquisition of assets offered for sale by other companies;

|

| • |

access to capital (debt and equity) for financing and operational purposes;

|

| • |

purchasing, leasing, hiring, chartering or other procuring of equipment that may be scarce; and

|

| • |

employment of qualified and experienced skilled management and gas and oil professionals and field operations personnel.

|

Competition in the Group’s markets is intense and depends, among other things, on the number of competitors in the market, their financial resources, their degree of geological, geophysical, engineering and

management expertise and capabilities, their degree of vertical integration and pricing policies, their ability to develop properties on time and on budget, their ability to select, acquire and develop reserves and their ability to foster and

maintain relationships with the relevant authorities. The cost to attract and retain qualified and experienced personnel has increased and may increase substantially in the future.

The Group’s competitors also include those entities with greater technical, physical and financial resources than the Group. Finally, companies and certain private equity firms not previously investing in natural gas

and oil may choose to acquire reserves to establish a firm supply or simply as an investment. Any such companies will also increase market competition which may directly affect the Group.

The effects of operating in a competitive industry may include:

| • |

higher than anticipated prices for the acquisition of licenses or assets;

|

| • |

the hiring by competitors of key management or other personnel; and

|

| • |

restrictions on the availability of equipment or services.

|

If the Group is unsuccessful in competing against other companies, the Group’s business, results of operations, financial condition, cash flows or prospects could be materially and adversely affected.

The Group may experience delays in production, transportation and marketing.

Various production, transportation and marketing conditions may cause delays in natural gas, NGLs and oil production and adversely affect the Group’s business. For example, the gas gathering systems that the Group

owns connect to other pipelines or facilities which are owned and operated by third parties. These pipelines and other midstream facilities and others upon which the Group relies on may become unavailable because of testing, turnarounds, line

repair, reduced operating pressure, lack of operating capacity, regulatory requirements, curtailments of receipt or deliveries due to insufficient capacity or because of damage. In periods where NGL prices are high, the Group benefits greatly from

the ability to process NGLs. The Group’s largest processors of Appalachian NGLs are the MarkWest Energy Partners, L.P., plant located in Langley, Kentucky, and the Blackbear Plant located in De Soto Parish, Louisiana. If the Group were to lose the

ability to process NGLs at these plants during a period of high pricing, the Group’s revenues would be negatively impacted. As a short-term measure, the Group could divert the natural gas through other pipeline routes; however, certain pipeline

operators would eventually decline to transport the gas due to its liquid content at a level that would exceed tariff specifications for those pipelines. The lack of available capacity on third-party systems and facilities could reduce the price

offered for the Group’s production or result in the shut-in of producing wells. Any significant changes affecting these infrastructure systems and facilities, as well as any delays in constructing new infrastructure systems and facilities, could

delay the Group’s production, which could materially and adversely impact the Group’s business, results of operations, financial condition, cash flows or prospects.

10

The Group faces production risks and hazards, including severe weather events, that may affect the Group’s ability to produce natural gas, NGLs and oil at expected levels,

quality and costs that may result in additional liabilities to the Group.

The Group’s natural gas and oil production operations are subject to numerous risks common to its industry, including, but not limited to, premature decline of reservoirs, incorrect production estimates, invasion of

water into producing formations, geological uncertainties such as unusual or unexpected rock formations and abnormal geological pressures, low permeability of reservoirs, contamination of natural gas and oil, blowouts, oil and other chemical

spills, explosions, fires, equipment damage or failure, challenges relating to transportation, pipeline infrastructure, natural disasters, uncontrollable flows of oil, natural gas or well fluids, adverse and severe weather conditions, shortages of

skilled labor, delays in obtaining regulatory approvals or consents, pollution and other environmental risks.

If any of the above events occur, environmental damage, including biodiversity loss or habitat destruction, injury to persons or property and other species and organisms, loss of life, failure to produce natural gas,

NGLs and oil in commercial quantities or an inability to fully produce discovered reserves could result. These events could also cause substantial damage to the Group’s property or the property of others and the Group’s reputation and put at risk

some or all of the Group’s interests in licenses, which enable the Group to produce, and could result in the incurrence of fines or penalties, criminal sanctions potentially being enforced against the Group and its management, as well as other

governmental and third-party claims. Consequent production delays and declines from normal field operating conditions and other adverse actions taken by third parties may result in revenue and cash flow levels being adversely affected.

Moreover, should any of these risks materialise, the Group could incur legal defense costs, remedial costs and substantial losses, including those due to injury or loss of life, human health risks, severe damage to

or destruction of property, natural resources and equipment, environmental damage, unplanned production outages, clean-up responsibilities, regulatory investigations and penalties, increased public interest in the Group’s operational performance

and suspension of operations, which could materially and adversely impact the Group’s business, results of operations, financial condition, cash flows or prospects.

The levels of the Group’s natural gas and oil reserves and resources, their quality and production volumes may be lower than estimated or expected.

The reserves data contained in the 2024 Annual Report for the Group incorporated by reference into this document have been audited by Netherland, Sewell & Associates, Inc. (“NSAI”)

unless stated otherwise. The standards utilised to prepare the reserves information that has been extracted in this document may be different from the standards of reporting adopted in other jurisdictions. Investors, therefore, should not assume

that the data found in the reserves information set forth in the 2024 Annual Report or in respect of the Maverick Group, incorporated by reference into this document is directly comparable to similar information that has been prepared in accordance

with the reserve reporting standards of other jurisdictions.

In general, estimates of economically recoverable natural gas, NGLs and oil reserves are based on a number of factors and assumptions made as of the date on which the reserves estimates were determined, such as

geological, geophysical and engineering estimates (which have inherent uncertainties), historical production from the properties or analogous reserves, the assumed effects of regulation by governmental agencies and estimates of future commodity

prices, operating costs, gathering and transportation costs and production related taxes, all of which may vary considerably from actual results.

Underground accumulations of hydrocarbons cannot be measured in an exact manner and estimates thereof are a subjective process aimed at understanding the statistical probabilities of recovery. Estimates of the

quantity of economically recoverable natural gas and oil reserves, rates of production and, where applicable, the timing of development expenditures depend upon several variables and assumptions, including the following:

| • |

production history compared with production from other comparable producing areas;

|

11

| • |

quality and quantity of available data;

|

| • |

interpretation of the available geological and geophysical data;

|

| • |

effects of regulations adopted by governmental agencies;

|

| • |

future percentages of sales;

|

| • |

future natural gas, NGLs and oil prices;

|

| • |

capital investments;

|

| • |

effectiveness of the applied technologies and equipment;

|

| • |

effectiveness of the Group’s field operations employees to extract the reserves;

|

| • |

natural events or the negative impacts of natural disasters;

|

| • |

future operating costs, tax on the extraction of commercial minerals, development costs and workover and remedial costs; and

|

| • |

the judgment of the persons preparing the estimate.

|

As all reserve estimates are subjective, each of the following items may differ materially from those assumed in estimating reserves:

| • |

the quantities and qualities that are ultimately recovered;

|

| • |

the timing of the recovery of natural gas and oil reserves;

|

| • |

the production and operating costs incurred;

|

| • |

the amount and timing of development expenditures, to the extent applicable;

|

| • |

future hydrocarbon sales prices; and

|

| • |

decommissioning costs and changes to regulatory requirements for decommissioning.

|

Many of the factors in respect of which assumptions are made when estimating reserves are beyond the Group’s control and therefore these estimates may prove to be incorrect over time. Evaluations of reserves

necessarily involve multiple uncertainties. The accuracy of any reserves evaluation depends on the quality of available information and natural gas, NGLs and oil engineering and geological interpretation. Furthermore, less historical well

production data is available for unconventional wells because they have only become technologically viable in the past twenty years and the long-term production data is not always sufficient to determine terminal decline rates. In comparison, some

conventional wells in the Group’s and Maverick Group’s portfolio have been productive for a much longer time. As a result, there is a risk that estimates of the Group’s and Maverick Group’s shale reserves are not as reliable as estimates of the

conventional well reserves that have a longer historical profile to draw on.

Interpretation, testing and production after the date of the estimates may require substantial upward or downward revisions in the Group’s and Maverick Group’s reserves and resources data. Moreover, different reserve

engineers may make different estimates of reserves and cash flows based on the same available data. Actual production, revenues and expenditures with respect to reserves will vary from estimates and the variances may be material.

If the assumptions upon which the estimates of the Group’s and/or Maverick Group’s natural gas and oil reserves prove to be incorrect or if the actual reserves available to the Group and/or Maverick Group (or the

operator of an asset in the Group has an interest) are otherwise less than the current estimates or of lesser quality than expected, the Group may be unable to recover and produce the estimated levels or quality of natural gas, NGLs or oil set out

in this document and this may materially and adversely affect the Group’s business, results of operations, financial condition, cash flows or prospects.

12

The PV-10 will not necessarily be the same as the current market value of the Group’s estimated natural gas, NGL and oil reserves.

Investors should not assume that the present value of future net cash flows from the Group’s reserves is the current market value of the Group’s estimated natural gas, NGL and oil reserves. Actual future net cash

flows from the Group’s natural gas and oil properties will be affected by factors such as:

| • |

actual prices it receives for natural gas, NGL and oil;

|

| • |

actual cost of development and production expenditures;

|

| • |

the amount and timing of actual production;

|

| • |

transportation and processing; and

|

| • |

changes in governmental regulations or taxation.

|

The timing of both the Group’s production and the Group’s incurrence of expenses in connection with the development and production of the Group’s natural gas and oil properties will affect the timing and amount of

actual future net cash flows from reserves, and thus their actual present value. In addition, the 10% discount factor the Group uses when calculating discounted future net cash flows may not be the most appropriate discount factor based on interest

rates in effect from time to time and risks associated with the Group or the natural gas and oil industry in general. Actual future prices and costs may differ materially from those used in the present value estimate.

The Group may face unanticipated increased or incremental costs in connection with decommissioning obligations such as plugging.

In the future, the Group may become responsible for costs associated with abandoning and reclaiming wells, facilities and pipelines which the Group uses for the processing of natural gas and oil reserves. With

regards to plugging, the Group is a party to agreements with regulators in the states of Ohio, West Virginia, Kentucky and Pennsylvania, setting forth plugging and abandonment schedules spanning a period ranging from 5 to 10 years. In the future, the Group may become subject to additional plugging obligation schedules with various States and regulators under contracts or current or future laws and

regulations. The Group will incur such decommissioning costs at the end of the operating life of some of the Group’s properties. The ultimate decommissioning costs are

uncertain and cost estimates can vary in response to many factors including changes to relevant legal requirements, the emergence of new restoration techniques, the shortage of plugging vendors, difficult terrain or weather conditions or experience

at other production sites. The expected timing and amount of expenditure can also change, for example, in response to changes in reserves, wells losing commercial viability sooner than forecasted or changes in laws and regulations or their

interpretation. As a result, there could be significant adjustments to the provisions established which would affect future financial results. The use of other funds to satisfy such decommissioning costs may impair the Group’s ability to focus

capital investment in other areas of the Group’s business, which could materially and adversely affect the Group’s business, results of operations, financial condition, cash flows or prospects.

The Group may not be able to keep pace with technological developments in its industry or be able to implement them effectively.

The natural gas and oil industry is characterised by rapid and significant technological advancements and introductions of new products and services using new technologies, such as emissions controls and processing

technologies. Rapid technological advancements in information technology and operational technology domains require seamless integration. Failure to integrate these technologies efficiently may result in operational inefficiencies, security

vulnerabilities, and increased costs.

13

During mergers and acquisitions, integrating technology assets from acquired companies can be complex. Poor integration may lead to data inconsistencies, security gaps and operational disruptions. Technology systems

are also susceptible to cybersecurity threats, including malware, data breaches, and ransomware attacks. These threats may disrupt operations, compromise sensitive data and lead to significant financial losses. Further, inefficient data management

practices may result in data breaches, data loss and missed opportunities for operational insights. The presence of legacy technology systems can also pose challenges, as they may lack modern security features, making them vulnerable to cyber

threats and necessitating costly upgrades.

As others use or develop new technologies, the Group may be placed at a competitive disadvantage or may be forced by competitive pressures to implement those new technologies at substantial costs. In addition, other

natural gas and oil companies may have greater financial, technical and personnel resources that allow them to enjoy technological advantages, which may in the future allow them to implement new technologies before the Group can. Additionally,

reliance on global supply chains for information technology hardware, software and operational technology equipment exposes the industry to supply chain disruptions, shortages and cybersecurity risks. The rapid advancement and adoption of

artificial intelligence (AI) technologies by competitors may also create operational and strategic risks and place the Group at a competitive disadvantage, particularly if the Group is unable to integrate such technologies effectively or at a

comparable pace.

If one or more of the technologies used now or in the future were to become obsolete, the Group’s business, results of operations, financial condition, cash flows or prospects could be materially and adversely

affected if competitors gain a material competitive advantage.

A lowering or withdrawal of the ratings, outlook or watch assigned to the Group or its asset-backed securities or Nordic Bonds by rating agencies may increase the Group’s future

borrowing costs and reduce its access to capital.

The rating, outlook or watch assigned to the Group or its asset-backed securities or Nordic Bonds could be lowered or withdrawn entirely by a rating agency if, in that rating agency’s judgment, current or future

circumstances relating to the basis of the rating, outlook, or watch such as adverse changes to the Group’s business, so warrant. The Group’s credit ratings may also change as a result of the differing methodologies or changes in the methodologies

used by the rating agencies. Any future lowering of the Group’s asset-backed securities or Nordic Bonds ratings, outlook or watch would likely make it more difficult or more expensive for the Group to obtain additional debt financing.

It is also possible that such ratings may be lowered in connection with the Group’s dual listing or in connection with future events, such as future acquisitions. Holders of the Shares will have no recourse against

the Group or any other parties in the event of a change in or suspension or withdrawal of such ratings. Any lowering, suspension or withdrawal of such ratings could materially and adversely affect the Group’s business, results of operations,

financial condition, cash flows or prospects.

Deterioration in the economic conditions in any of the industries in which the Group’s customers operate, a US or worldwide financial downturn, or negative credit market

conditions could have a material adverse effect on the Group’s liquidity, results of operations, business and financial condition that it cannot predict.

Economic conditions in a number of industries in which the Group’s customers operate have experienced substantial deterioration in the past, resulting in reduced demand for natural gas and oil. Renewed or continued

weakness in the economic conditions of any of the industries the Group serves or that are served by the Group’s customers, or the increased focus by markets on carbon-neutrality, could adversely affect the Group’s business, financial condition,

results of operation and liquidity in a number of ways. For example:

| • |

demand for natural gas and electricity in the United States is impacted by industrial production, which if weakened would negatively impact the revenues, margins and profitability of the Group’s natural gas business;

|

| • |

a decrease in international demand for natural gas or NGLs produced in the United States could adversely affect the pricing for such products, which could adversely affect the Group’s results of operations and liquidity;

|

14

| • |

the tightening of credit or lack of credit availability to the Group’s customers could adversely affect the Group’s liquidity, as the Group’s ability to receive payment for its products sold and delivered depends on the continued

creditworthiness of the Group’s customers;

|

| • |

the Group’s ability to refinance its Credit Facility may be limited and the terms on which the Group is able to do so may be less favorable to the Group depending on the strength of the capital markets or the Group’s credit ratings;

|

| • |

the Group’s ability to access the capital markets may be restricted at a time when it would like, or need, to raise capital for the Group’s business including for exploration and/or development of the Group’s natural gas reserves;

|

| • |

increased capital markets scrutiny of oil and gas companies may lead to increased costs of capital or lack of credit availability; and

|

| • |

a decline in the Group’s creditworthiness may require it to post letters of credit, cash collateral, or surety bonds to secure certain obligations, all of which would have an adverse effect on the Group’s liquidity.

|

The Group’s operations are subject to a series of risks relating to climate change.

Continued public concern regarding climate change and potential mitigation through regulation could have a material impact on the Group’s business. While the current U.S. administration has lessened existing

regulations, other international agreements, regional, state and local legislation, and regulatory measures to limit GHG emissions are currently in place or in various stages of discussion or implementation. Given that some of the Group’s operations are associated with emissions of GHGs, GHG emissions-related laws, policies and regulations may still result in substantial capital, compliance, operating and

maintenance costs, with the level of expenditure varying depending on the laws enacted by particular countries, states, provinces and municipalities.

Internationally, the United Nations-sponsored “Paris Agreement” requires member nations to individually determine and submit non-binding emissions reduction targets every five years after 2020. In November 2021, the

international community gathered in Glasgow at the 26th Conference of the Parties to the UN Framework Convention on Climate Change, during which multiple announcements were made, including a call for parties to eliminate certain fossil fuel

subsidies and pursue further action on non-carbon dioxide GHGs. In January 2025, President Trump signed an executive order directing the United States to withdraw from the Paris Agreement. Despite any directed and future withdrawals and rolling

back of GHG commitments by the U.S. government, emission reduction targets and other provisions of legislative or regulatory initiatives and policies enacted in the future by the United States may still be possible or, in the absence of federal

action, some states in which the Group operates may become more active and focused on taking legislative or regulatory actions aimed at climate change and minimizing GHG emissions. This could adversely impact the Group’s business by imposing

increased costs in the form of higher taxes or increases in the prices of emission allowances, limiting the Group’s ability to develop new gas and oil reserves, transport hydrocarbons through pipelines or other methods to market, decreasing the

value of the Group’s assets, or reducing the demand for hydrocarbons and refined petroleum products. Further, the consequences of the effects of global climate change and the continued political and societal attention afforded to mitigating the

effects of climate change may generate adverse investor and stakeholder sentiment towards the hydrocarbon industry and negatively impact the ability to invest in the sector. Similarly, longer term reduction in the demand for hydrocarbon products

due to the pace of commercial deployment of alternative energy technologies or due to shifts in consumer preference for lower GHG emissions products could reduce the demand for the hydrocarbons that the Group produces.

Further, in response to concerns related to climate change, companies in the fossil fuel sector may be exposed to increasing financial risks. Financial institutions, including investment advisors and certain

sovereign wealth, pension and endowment funds, may elect in the future to shift some or all of their investment into non-fossil fuel related sectors. Some institutional lenders who provide financing to fossil-fuel energy companies may elect in the

future to limit or not provide funding for fossil fuel energy companies. A material reduction in the capital available to the fossil fuel industry could make it more difficult to secure funding for exploration, development, production, and

transportation activities, which could in turn materially and adversely affect the Group’s business, results of operations, financial condition, cash flows or prospects.

15

The Group may also be subject to activism from environmental non-governmental organisations (“NGOs”) campaigning against fossil fuel extraction or negative publicity from media

alleging inadequate remedial actions to retire non-producing wells effectively, which could affect the Group’s reputation, disrupt its programs, require the Group to incur significant, unplanned expense to respond or react to intentionally

disruptive campaigns or media reports, create blockades to interfere with operations or otherwise adversely impact the Group’s business, results of operations, financial condition, cash flows or prospects. Litigation risks are also increasing as a

number of entities have sought to bring suit against various oil and natural gas companies in state or federal court, alleging among other things, that such companies created public nuisances by producing fuels that contributed to climate change or

alleging that the companies have been aware of the adverse effects of climate change for some time but defrauded their investors or customers by failing to adequately disclose those impacts.

Finally, the Group’s operations are subject to disruption from the physical effects that may be caused or aggravated by climate change. These include risks from extreme weather events, such as hurricanes, severe

storms, floods, heat waves, and ambient temperature increases, as well as wildfires, each of which may become more frequent or more severe as a result of climate change.

The Group relies on third-party infrastructure that it does not control and/or, in each case, is subject to tariff charges that it does not control.

A significant portion of the Group’s production passes through third-party owned and controlled infrastructure. If these third-party pipelines or liquids processing facilities experience any event that causes an

interruption in operations or a shut-down such as mechanical problems, an explosion, adverse weather conditions, a terrorist attack or labor dispute, the Group’s ability to produce or transport natural gas could be severely affected. For example,

the Group has an agreement with a third party where approximately 39% of the NGLs sold by the Group during the year ending 31 December 2024 were processed at the third party’s facility in Kentucky. Any material decrease in the Group’s ability to

process or transport its natural gas through third-party infrastructure could have a material adverse effect on the Group’s business, results of operations, financial condition, cash flows or prospects.

The Group’s use of third-party infrastructure may be subject to tariff charges. Although the Group seeks to manage its flow via its midstream infrastructure, the Group may not always be able to avoid higher tariffs

or basis blowouts due to the lack of interconnections. In such instances, the tariff charges can be substantial and the cost is not subject to the Group’s direct control, although the Group may have certain contractual or governmental protections

and rights. Generally, the operator of the gathering or transmission pipelines sets these tariffs and expenses on a cost sharing basis according to the Group’s proportionate hydrocarbon through-put of that facility. A provisional tariff rate is

applied during the relevant year and then finalised the following year based on the actual final costs and final through-put volumes. Such tariffs are dependent on continued production from assets owned by third parties and, may be priced at such a

level as to lead to production from the Group’s assets ceasing to be economic and thus may have a material adverse effect on the Group’s business, results of operations, financial condition, cash flows or prospects.

Furthermore, the Group’s use of third-party infrastructure exposes it to the possibility that such infrastructure will cease to be operational or be decommissioned and therefore require the Group to source

alternative export routes and/or prevent economic production from the Group’s assets. This could also have a material adverse effect on the Group’s business, results of operations, financial condition, cash flows or prospects.

Failure by the Group, its contractors or its primary offtakers to obtain access to necessary equipment and transportation systems could materially and adversely affect the

Group’s business, results of operations, financial condition, cash flows or prospects.

The Group relies on its natural gas and oil field suppliers and contractors to provide materials and services that facilitate the Group’s production activities, including plugging and abandonment contractors. Any

competitive pressures on the oil field suppliers and contractors could result in a material increase of costs for the materials and services required to conduct the Group’s business and operations. For example, the Group is dependent on the

availability of plugging vendors to help it satisfy abandonment schedules that the Group has agreed to with the states of Ohio, West Virginia, Kentucky and Pennsylvania. In the future, the Group may become subject to additional plugging obligation

schedules with various States and regulators under contracts or current or future laws and regulations. Such personnel and services can be scarce and may not be

readily available at the times and places required. Future cost increases could have a material adverse effect on the Group’s asset retirement liability, operating income, cash flows and borrowing capacity and may require a reduction in the

carrying value of the Group’s properties, the Group’s planned level of spending for development and the level of the Group’s reserves. Prices for the materials and services the Group depends on to conduct its business may not be sustained at levels

that enable the Group to operate profitably.

16

The Group and its offtakers rely, and any future offtakers will rely, upon the availability of pipeline and storage capacity systems, including such infrastructure systems that are owned and operated by third

parties. As a result, the Group may be unable to access or source alternatives for the infrastructure and systems which it currently uses or plans to use, or otherwise be subject to interruptions or delays in the availability of infrastructure and

systems necessary for the delivery of its natural gas, NGLs and oil to commercial markets. In addition, such infrastructure may be close to its design life and decisions may be taken to decommission such infrastructure or perform life extension

work to maintain continued operations. Any of these events could result in disruptions to the Group’s projects and thereby impact the Group’s ability to deliver natural gas, NGLs and oil to commercial markets and/or may increase the Group’s costs

associated with the production of natural gas, NGLs and oil reliant upon such infrastructure and systems. Further, the Group’s offtakers could become subject to increased tariffs imposed by government regulators or the third-party operators or

owners of the transportation systems available for the transport of the Group’s natural gas, NGLs and oil, which could result in decreased offtaker demand and downward pricing pressure.

If the Group is unable to access infrastructure systems facilitating the delivery of its natural gas, NGLs and oil to commercial markets due to the Group’s contractors or primary offtakers being unable to access the

necessary equipment or transportation systems, the Group’s operations will be adversely affected. If the Group is unable to source the most efficient and expedient infrastructure systems for its assets then delivery of its natural gas, NGLs and oil

to the commercial markets may be negatively impacted, as may its costs associated with the production of natural gas, NGLs and oil reliant upon such infrastructure and systems.

A proportion of the Group’s equipment has substantial prior use and significant expenditure may be required to maintain operability and operations integrity.

A part of the Group’s business strategy is to optimise or refurbish producing assets where possible to maximise the efficiency of the Group’s operations while avoiding significant expenses associated with purchasing

new equipment. The Group’s producing assets and midstream infrastructure require ongoing maintenance to ensure continued operational integrity. For example, some older wells may struggle to produce suitable line pressure and will require the

addition of compression to push natural gas. Despite the Group’s planned operating and capital expenditures, there can be no guarantee that the Group’s assets or the assets it uses will continue to operate without fault and not suffer material

damage in this period through, for example, wear and tear, severe weather conditions, natural disasters or industrial accidents. If the Group’s assets, or the assets it uses, do not operate at or above expected efficiencies, the Group’s may be

required to make substantial expenditures beyond the amounts budgeted. Any material damage to these assets or significant capital expenditure on these assets for improvement or maintenance may have a material adverse effect on the Group’s business,

results of operations, financial condition, cash flows or prospects. In addition, as with planned operating and capital expenditure, there is no guarantee that the amounts expended will ensure continued operation without fault or address the

effects of wear and tear, severe weather conditions, natural disasters or industrial accidents. The Group cannot guarantee that such optimisation or refurbishment will be commercially feasible to undertake in the future and the Group cannot provide

assurance that it will not face unexpected costs during the optimisation or refurbishment process.

The Group depends on its directors, key members of management, independent experts, technical and operational service providers and on the Group’s ability to retain and hire

such persons to effectively manage its growing business.